State of Business Snapshot:

Brokers from 35 Countries Weigh-In

In August 2020, we polled real estate Brokers and Office Managers worldwide about their experiences and opinions on how the global pandemic has affected local business. Our goal was to better understand the effects of the Coronavirus pandemic on key real estate activities and industry health measures and to identify international trends. We asked about the impact that the pandemic has had on their investment in technology, property prices, domestic and international demand, office revenue and expenses, ability to recruit and retain talent, and how much longer they think the pandemic will continue impacting business.

Please find a summary of our findings below. While some of the trends may have been expected, the impact scope and correlations may not have been. We also gained interesting insights from the open-ended questions where respondents elaborated on local implications.

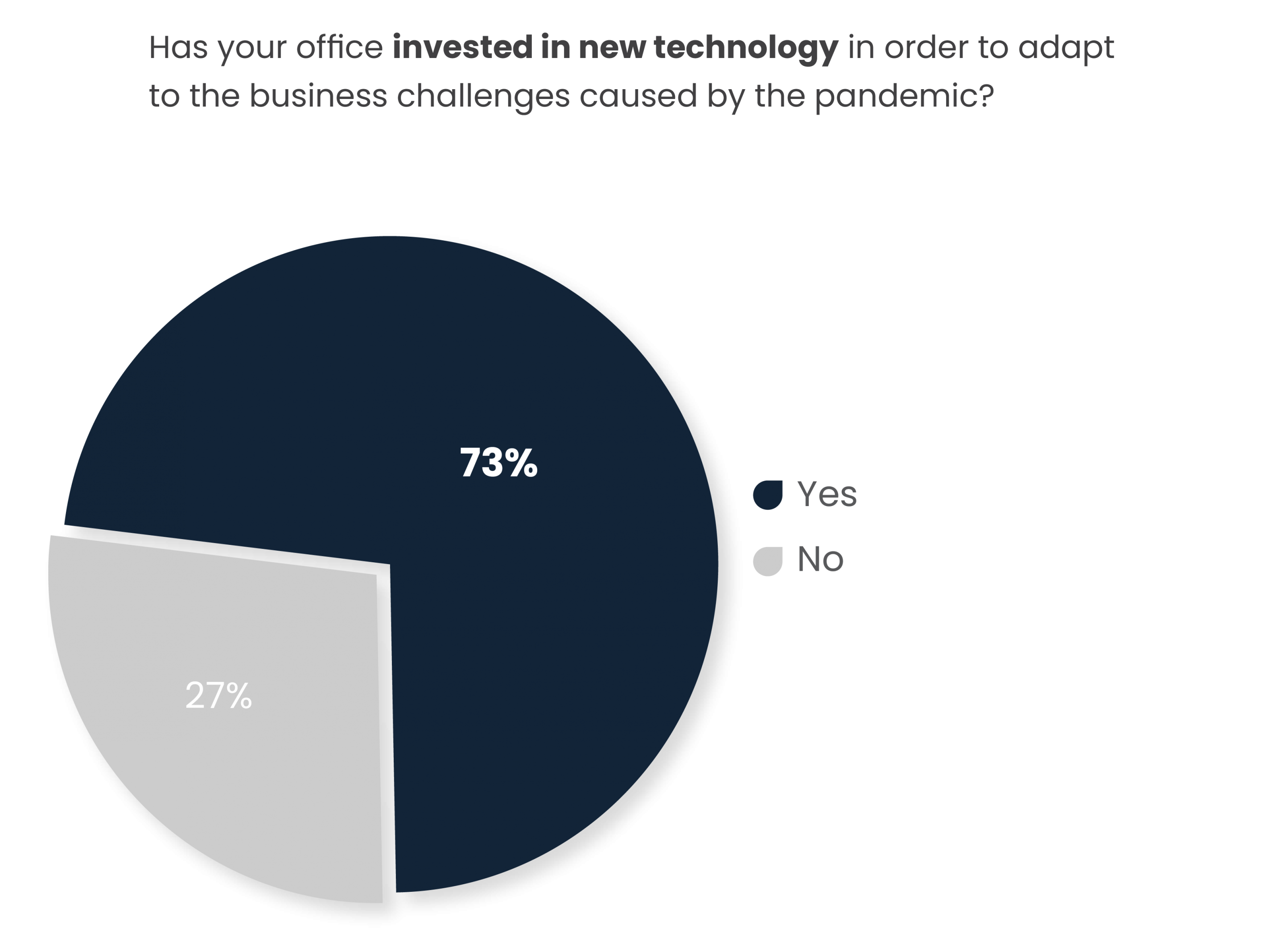

Investment in New Technology

We asked survey respondents “Has your office invested in new technology in order to adapt to the business challenges caused by the pandemic” and an overwhelming majority (73%) answered “yes”. Many of the accompanying comments referenced the need for business continuity and to ensure safe business practices as the catalyst for seeking new technology solutions. Virtual property showing software and virtual collaboration software were common investments noted. Among the 27% of respondents who replied “no”, that they had not invested in new technology in order to adapt, there did not appear to be any commonality across company size nor geography of these respondents.

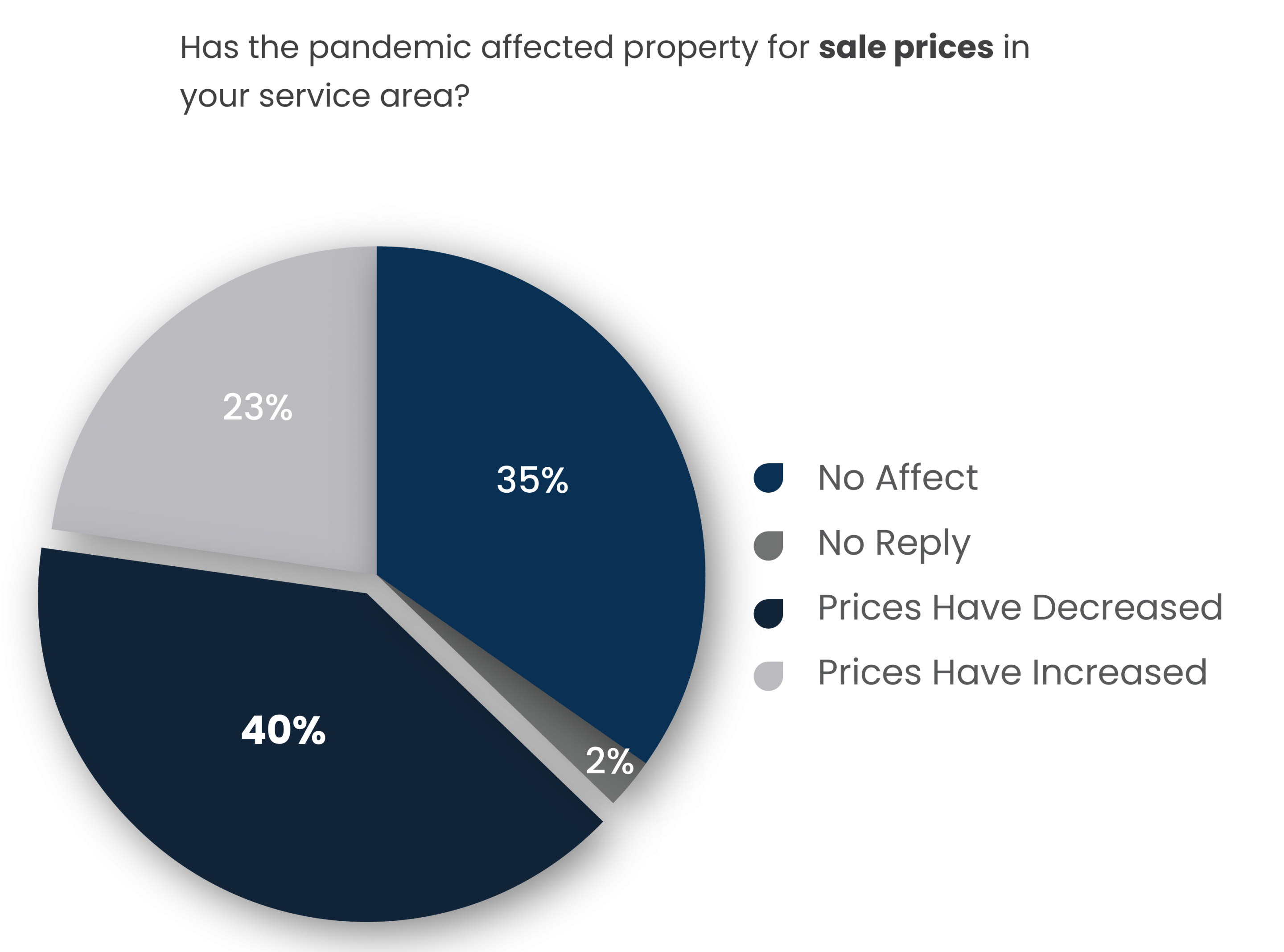

Affect on Property Prices

Overall, more survey respondents cited a decrease (40%) than an increase (23%) in property prices in their local service areas. However, a fair percentage (35%) shared that they have not seen any affect of the pandemic on property prices. With 58% stating either no affect or an increase in property prices, industry resiliency is a reasonable conclusion. Those who cited price declines pointed to reduced buyer demand due to economic hardships, i.e. unemployment. Whereas, ideal buyer demographics, e.g. millennials (ages 23-38), and attractive mortgage rates were the main influencing factors that respondents pointed to for price increases.

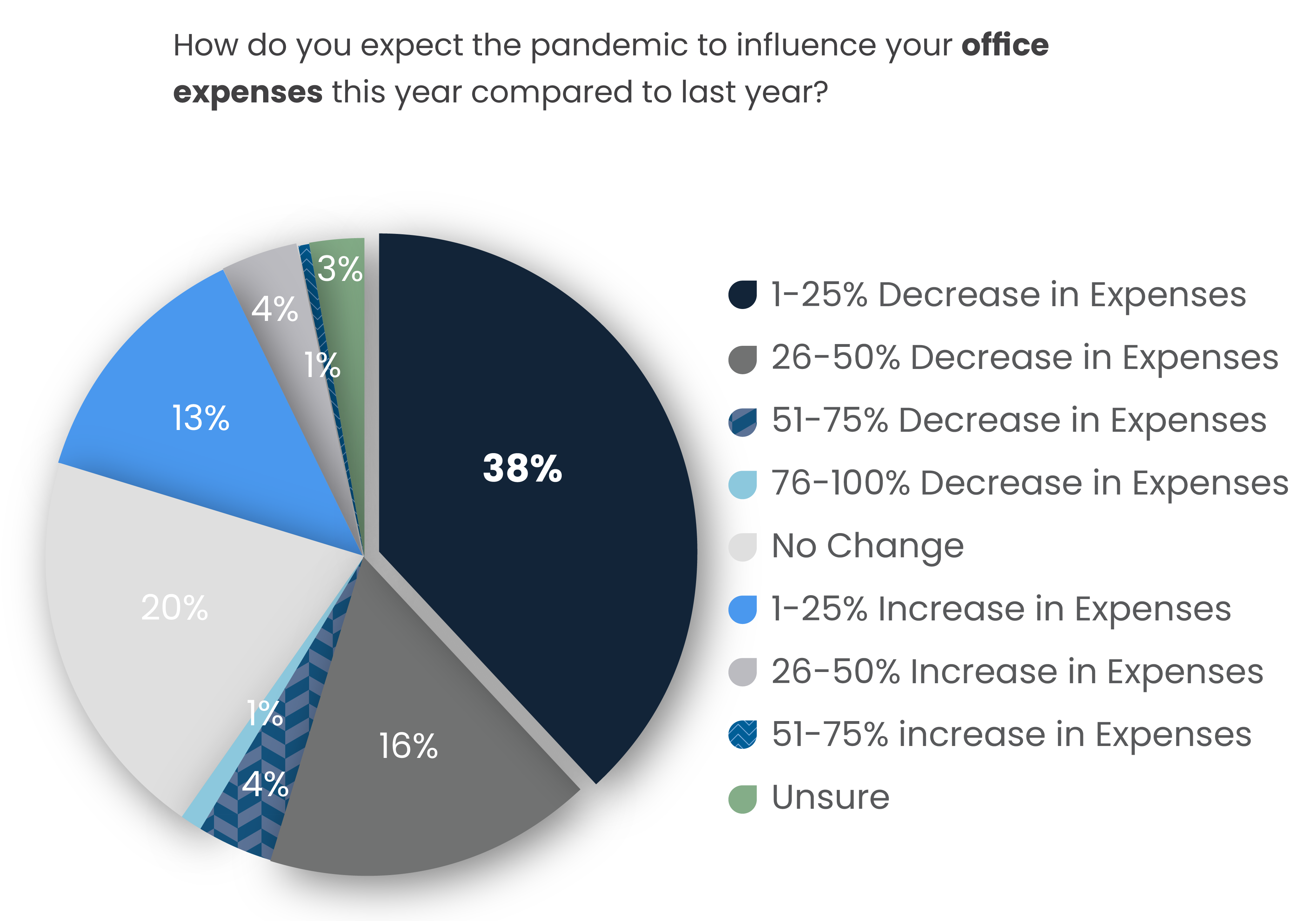

Influence on Office Expenses

59% of survey respondents said they expected their office expenses in 2020 to decline compared to last year with majority (54%) expecting a decline of up to 50% (38% cited a 1-25% decline and 16% cited a 26-50% decline). Whereas, only 18% expected an increase in expenses year-over-year and 20% expect no change at all. Some respondents pointed to an increased investment in software to support office collaboration and digital advertising as the main sources for the increased expenditure.

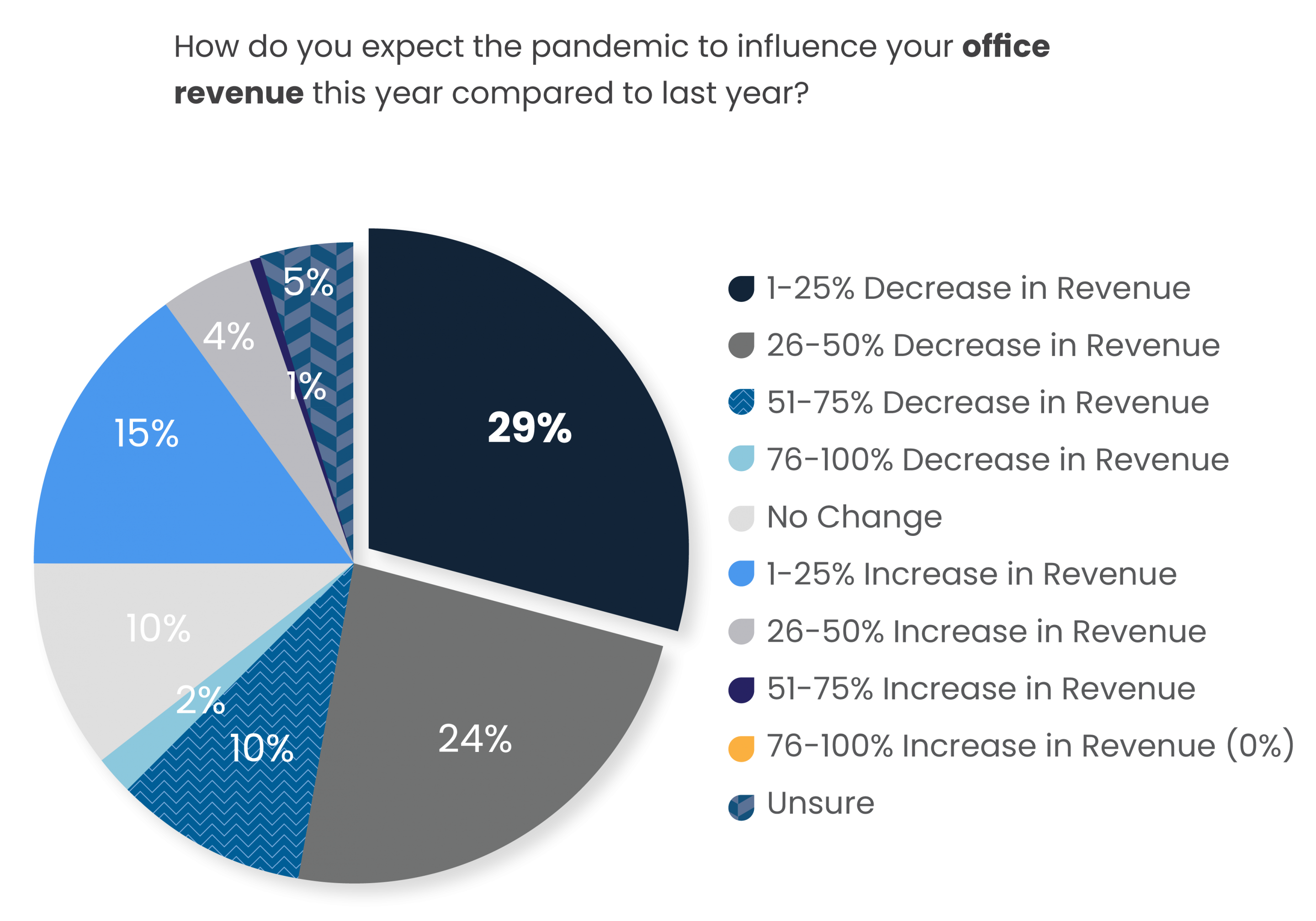

Influence on Office Revenue

Similarly to office expenses, majority (65%) of respondents said they expect a decrease in office revenue this year compared to last due to the pandemic. Whereas, only 20% expect an increase and 10% did not expect any change. Comments from respondents suggest that economic volatility and employment instability caused by the pandemic has impacted consumer confidence, stalling demand, which in turn has lessened the number of transactions an office typically sees. Interestingly, 73% of those respondents who expected some measure of decrease in their expenses year-over-year also expected a decrease in their office revenue year-over-year, suggesting less business activity for at least a portion of 2020.

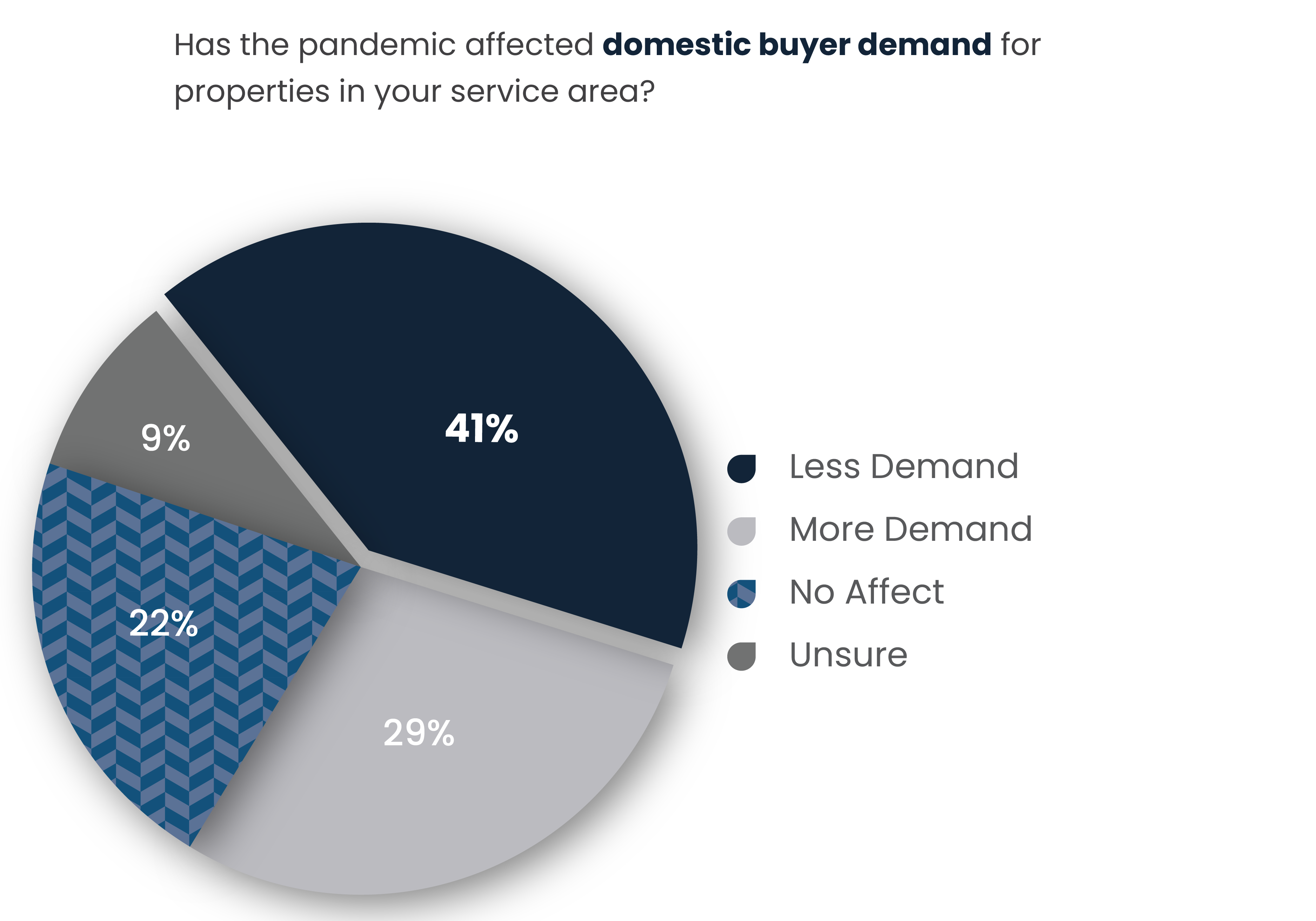

Affect on Domestic Buyer Demand

There is a mixed response on the affect of the pandemic on domestic buyer demand. 41% of survey respondents said the demand from domestic buyers has declined due to the pandemic, while 29% said they are experiencing increased demand and 22% cited no affect. There does not appear to be any correlation with response type and geography nor company size. Those who stated a decrease in demand, pointed to a lack of consumer confidence in the economy, a reluctance to attend open houses for safety reasons, and employment uncertainty. Whereas those who cited an increase in demand suggested that increased flexibility from employers to work remotely from anywhere and low interest rates make the prospect of buying attractive.

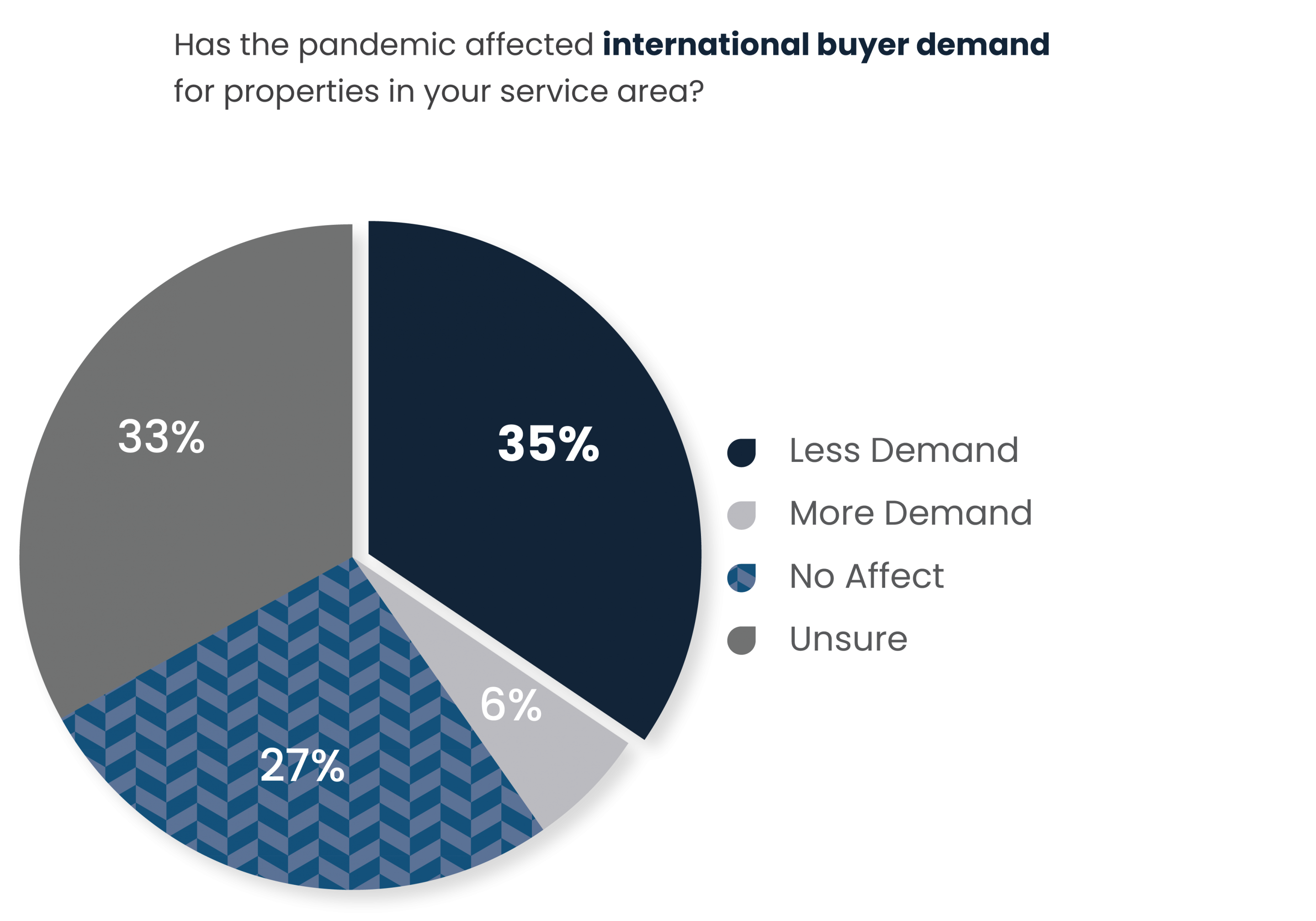

Affect on International Buyer Demand

As is the case with domestic buyer demand, of those who responded with certainty, majority (35%) said that international buyer demand has declined due to the pandemic, whereas only 6% of respondents cited increased international demand and 27% said they have not seen any affect. Overall, 62% of respondents stated that international demand has either decreased (35%) or remained the same (27%) during the pandemic. This is perhaps not surprising given global travel restrictions have limited the ability of prospective international buyers to visit desired regions and properties. It should be noted that 33% of respondents were unsure.

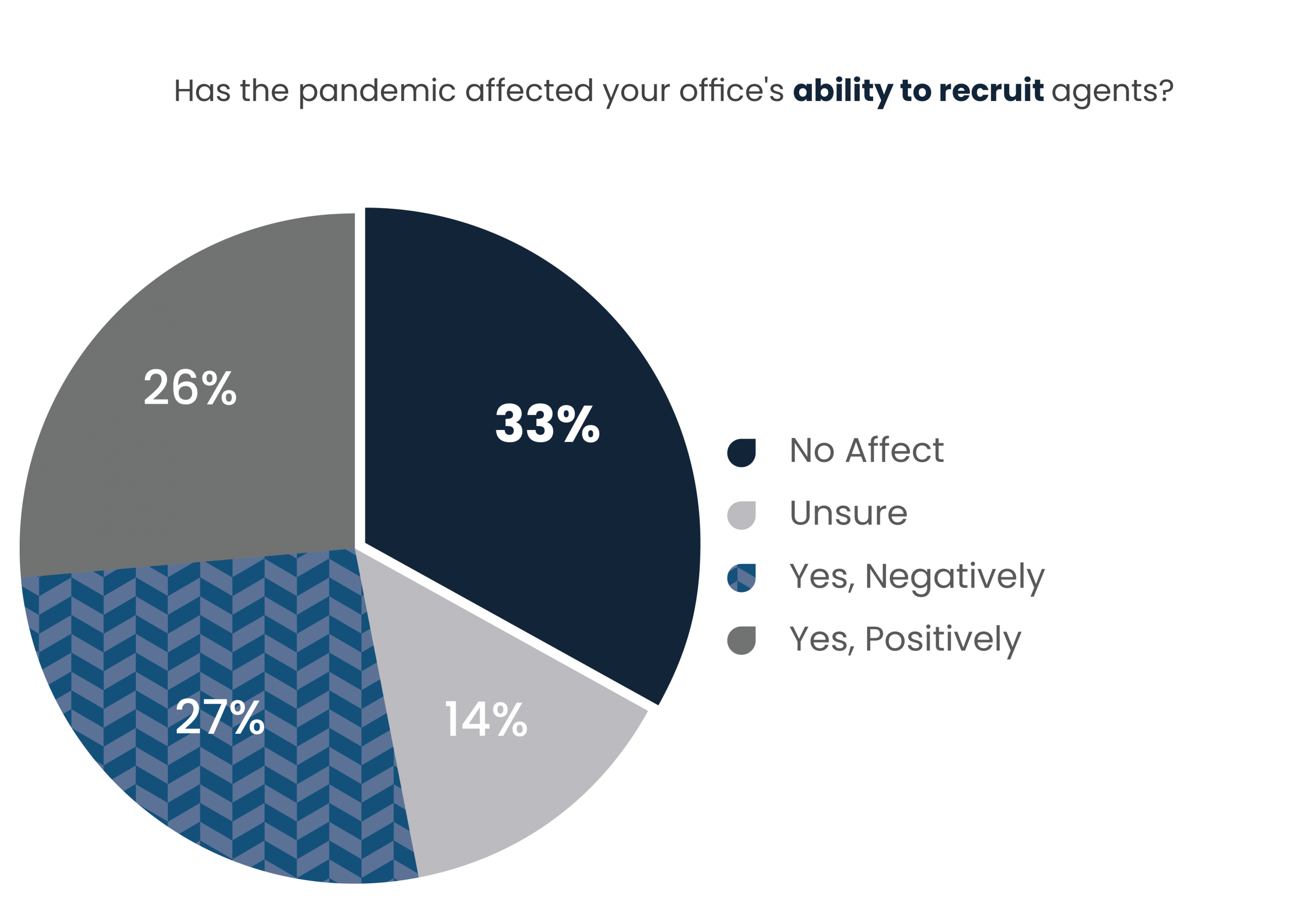

Ability to Recruit Agents

There is a balanced divide between responses on whether or not the pandemic has affected their office’s ability to recruit agents. 33% of survey respondents said that there has been no affect, 27% cited a negative affect and 26% cited a positive affect. Among our data sample, there does not seem to be any correlations between response type and company size nor geography. Variations in the health of local economies, unemployment rates, and the effectiveness of government programs to support the industry and its citizens, were all influencing factors offered by respondents.

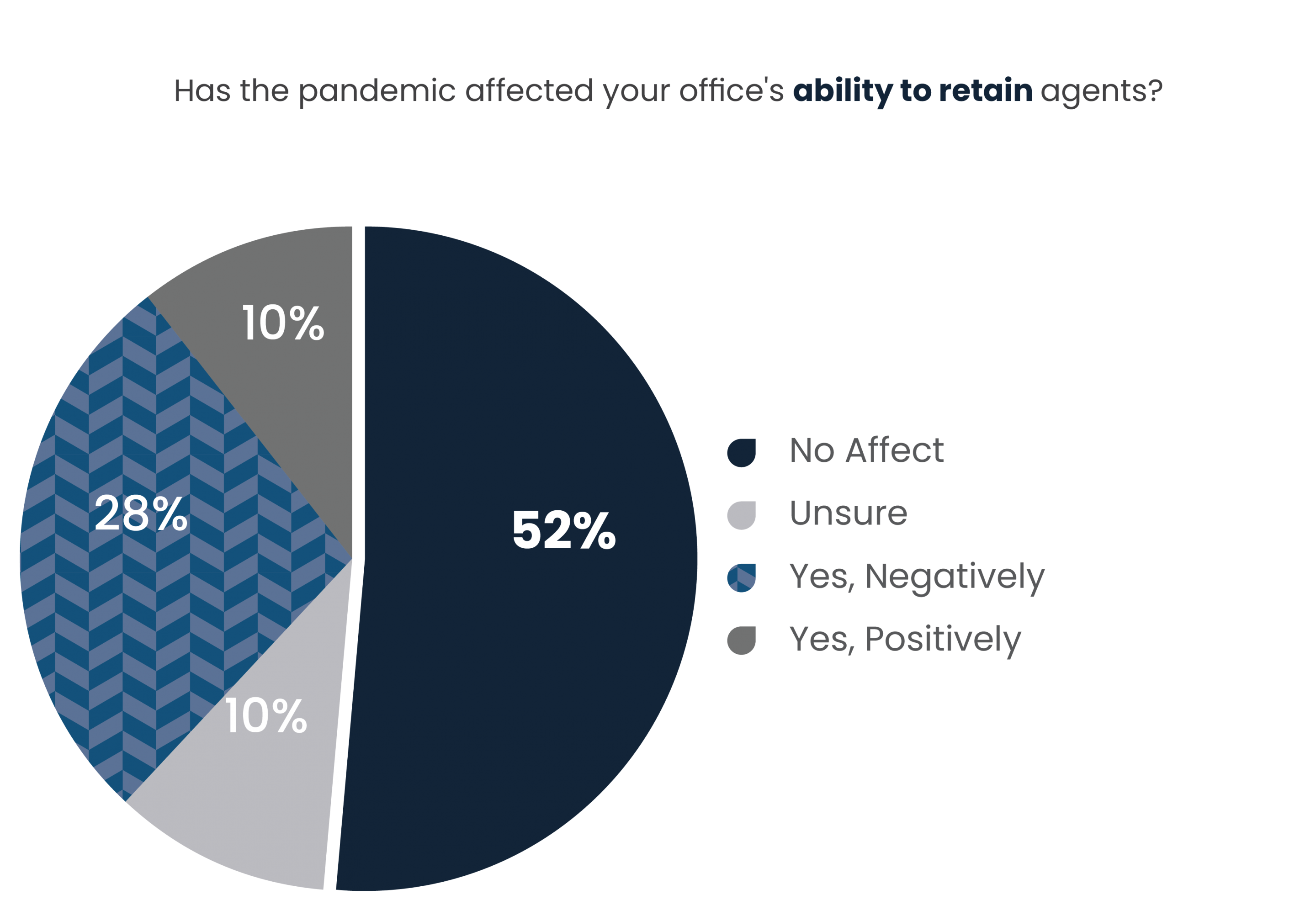

Ability to Retain Agents

Over 50% of respondents stated that the pandemic has had no affect on their office’s ability to retain agents. 28% said that the pandemic has negatively influenced their ability to retain agents and only 10% cited that the pandemic has had a positive affect. Like agent recruitment, there does not seem to be any correlations with company size nor geography influencing these responses among our data sample. Respondents suggested a general reluctance to make employment changes during economic uncertainty as one reason why some agents may be choosing to stay where they are for the time being. Others suggested that the pandemic has caused a shift in priorities with many agents looking for job security while they try and balance the needs of family to get them through these difficult times.

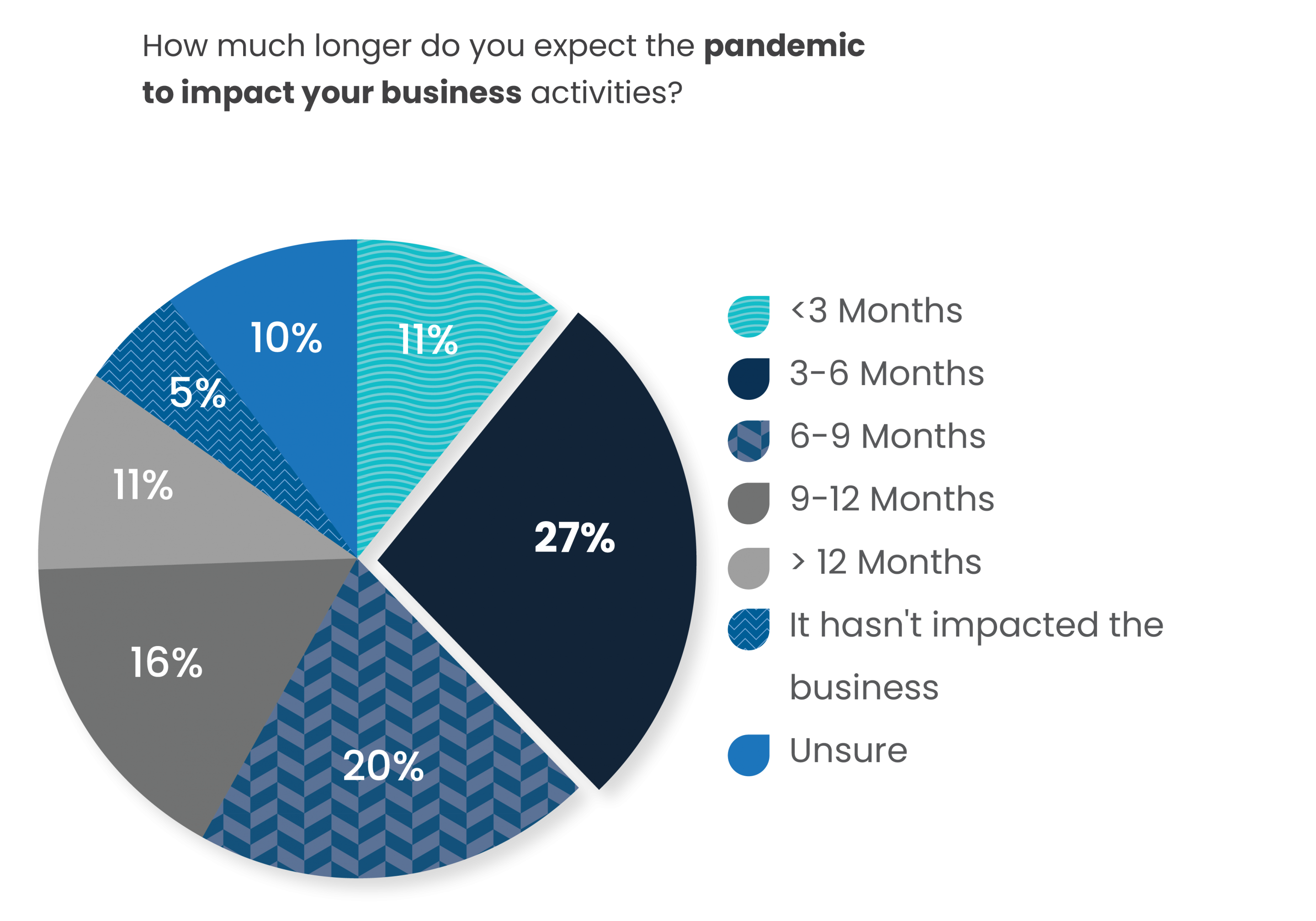

How Much Longer Will it Last?

As the pandemic continues to impact economies and industries worldwide in the second half of 2020, we asked respondents “how much longer do you expect the pandemic to impact your business activities?” 38% responded less than 6 months and 47% responded more than 6 months, while 10% said they were unsure and 5% said that they have not experienced a business impact. There were numerous and wide-ranging reasons given for these expectations – some global in nature (i.e. dependent on the timeframe of a broadly available COVID-19 vaccine) and others local (i.e. the anticipated lifting of local government policies that limit economic progress).

In summary, the results of this survey indicate that within our data sample, the majority of key real estate business practices we surveyed about have been affected by the pandemic, albeit at different magnitudes and in different ways. The open-ended comments revealed that the pandemic is perceived as a catalyst for technology innovation and adoption and that it has provided opportunity for businesses to re-evaluate and optimize their practices in pursuit of a better way to adapt and thrive.

Achieving success in international real estate requires a clear understanding of local markets, cultures, and industry practices. At PropTech Solutions, we know international real estate. For over 22 years, we have been helping real estate companies from 60+ countries worldwide accelerate their growth with innovative technology. By leveraging our flexible, localized, multilingual and multicurrency lead-to-close platform, enterprise customers can effectively manage and grow their business.

About our Survey

The survey was made available for one month (July 13, 2020 to Aug 14, 2020) in 4 languages (English, French, Spanish and Portuguese). It was targeted at Brokers, Office Managers and Office Administrators of residential real estate companies worldwide. We received 155 valid responses from respondents across 35 countries. The respondents reported their company size by agent count as follows: <10 agents (38%), 11-50 agents (44%), 51-100 agents (14%), 101-200 agents (2%) and >200 agents (2%). Note: The survey respondents were offered a chance to win a technology prize as an incentive to participate.

"We're going to get through this together. As countries enact measures to restart their economic engines, record low interest rates will make the prospect of buying properties more attractive. If we also account for the pent up demand this period of suppressed market activity will create, it’s very likely we will see a period of increased real estate activity once social distancing measures are relaxed. The work agents do now to optimize and organize their contact databases, reach out to the contacts they haven't spoken to in a while, and make new virtual connections online, will pay dividends down the line."

The Real Estate Platform (REP) is powered by Phoenix Software, a PropTech Solutions company. REP is an enterprise global technology platform empowering real estate companies around the world to manage and grow their business. From lead-to-close, REP offers tools to empower every level of your organization, such as lead generating websites, CRM, listings management, transaction management, teams management, marketing, lead qualification and nurture, reporting, business intelligence and more. REP is currently used by global real estate brands worldwide including Keller Williams, EXP, Coldwell Banker, ERA and others. Request a demo to see how REP can help you grow your business.

Stay Informed

Subscribe to our Blog to receive monthly insights and information to help you expand and prosper in international real estate.

Request a Demo of REP

Let us answer your questions and show you how The Real Estate Platform (REP) can help you achieve your goals.